Overview of Professional Tax Registration

Taxation is considered an initial source for the government of India. Professional Tax is also a type of taxation that is levied on all salaried individuals. The salaried employees can notice the Professional Tax on their salary slips. It varies from state to state. It is collected by the state government. Every state has implemented its laws, rules, and regulations accordingly. It has been levied on all types of professions, trades, and employment based on the income of their earnings.

What is Professional Tax?

Professional Tax is a direct tax levied by the State Government in India on individuals earning income through practicing a profession such as Company Secretary, Lawyer, Chartered Accountant, Doctor, etc. However, the tax is not only applied to salaried professionals but also to Non-Government Institution employees. It is similar to Income Tax. The difference between the two arose as Professional Tax is levied by the State Government and Income tax is levied by the Central Government. It has been fixed to an annual amount of Rs. 2500/-. At present, it has been treated as regressive due to its fixed nature of amount as individuals with high salaries also pay the same amount of tax.

Components of Professional Tax

- Professional Tax – Employer

- Professional Tax – Employee

Every business entity shall acquire the Professional Tax Registration/ Enrolment Certificate from the respective state government while the commencement of business or within 30 days of its commencement. It shall be payable to the State Government on an annual basis of the amount Rs.2500/- by the employer.

Every Employee whose income is mentioned under the state tax slab rate for Professional Tax shall pay the maximum amount of tax as prescribed by the respective state government. The amount so prescribed under professional tax shall be deductible by the salary of the employee and payable to the government.

Professional Tax Rate

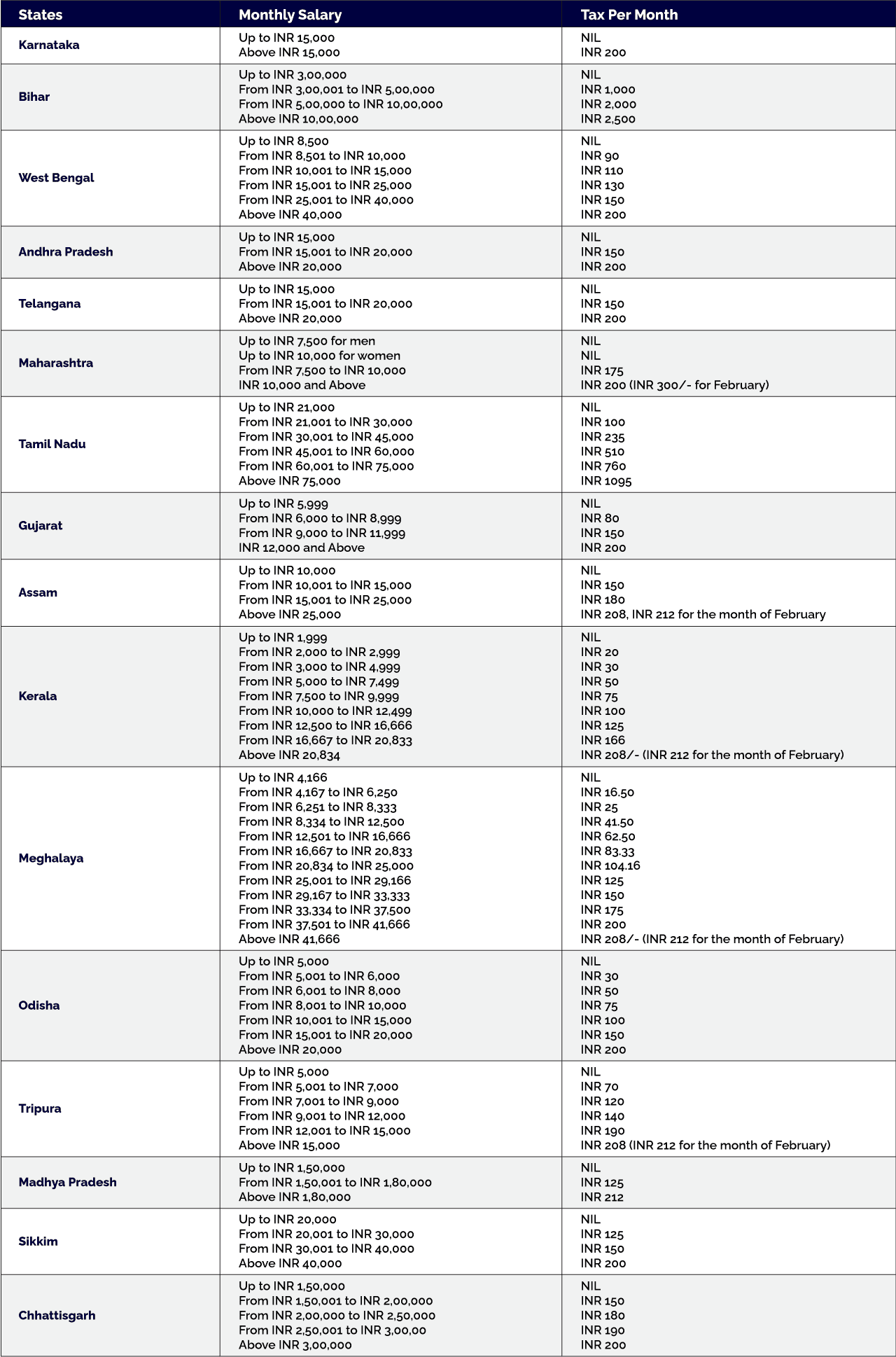

The Professional Tax Rate has been fixed to an annual amount of Rs.2500/-. It is based on the tax slab on the gross income of the salaried individuals. The amount is deductible every month from their income. It has been levied by the following State Governments: Karnataka, West Bengal, Andhra Pradesh, Chhattisgarh, Kerala, Maharashtra, Tamil Nadu, Gujarat, Assam, Orissa, Tripura, Madhya Pradesh, and Meghalaya. It is deducted by the Employer from the salary or wages of the employee. And the same has to be sent to the respective State Government by the Employer. On the other hand, the other class of individuals is liable to pay the tax by themself.

Benefits of Professional Tax Registration

It has various benefits; some of which are mentioned below-

- Imposes Minimal Restriction

- No Delay

- Easy Registered

- Implementing Welfare & Development Programs

- Can Get Professional Help

- Can Claim Deduction

It has minimum restrictions for its compliance. And the process for the same is also easy to comply with.

Professional Tax is regarded as a legal requirement. And thus neglecting the same would impose a fine or prosecution on the taxpayer. To avoid such a situation, the taxpayer i.e. employer and employee pay off their tax on time as per the tax slab rates of their respective states.

The professional tax has easy procedures for registration and other follow-ups and proceedings are also easy to be compiled.

The Professional Tax is revenue for the State Government which helps out with the welfare and development of the state.

No one will ever have to deal with all the tax-related issues on their own again. Since there are tax professionals helping you with the tax-related work, thus one will never be alone again when it comes to tax woes.

The Employer or the Employee person can claim a deduction for the professional tax which is paid previously.

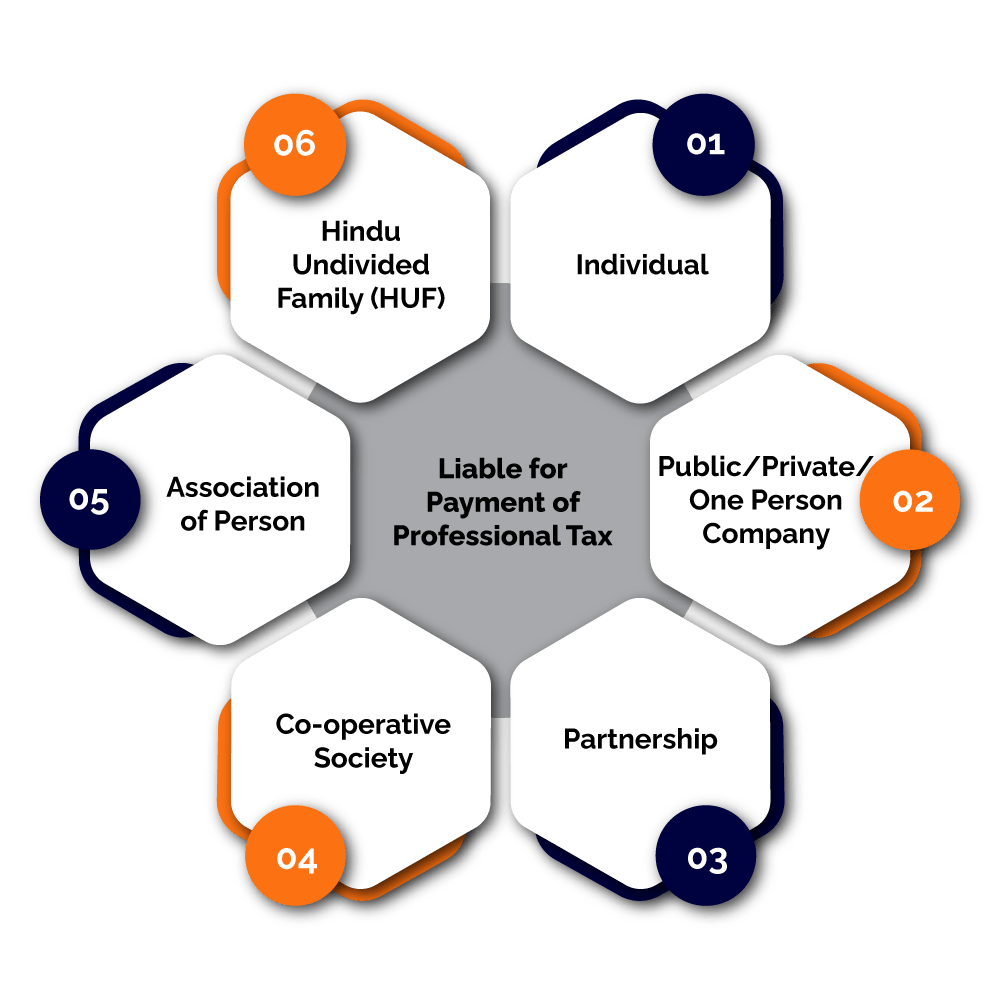

Liability for Payment of Professional Tax

The Below-mentioned class of persons is liable for paying the Professional tax:

- Individual

- Public/Private/One-person Company

- Partnership

- Co-operative Society

- Association of Person

- HUF (Hindu Undivided Family)

Exemptions for Paying Professional Tax

Following are the entities exempted from the Professional Tax-

- The Parents, whose children suffer from permanent disability or mental disability or any other such type of disability, are exempted from paying the Professional Tax.

- The members of the forces who serve the state under the Army Act, of 1950, the Air Force Act, of 1950, and the Navy Act, of 1957 also including the members of the auxiliary forces and reservists are exempted from paying the Professional Tax.

- Any person who is above 65 years of age is also exempted from professional tax liability.

- Any person who is suffering from a permanent physical disability including blindness is also exempted from Professional Tax.

- Any Woman who is working as an agent for the Mahila Pradhan Kshetriya Bachat Yojana or as a Director for any small savings scheme in the state shall be exempted from paying Professional Tax.

- The parents or guardians of any person who is suffering from mental or permanent disability.

- Any temporary workers [Badli workers] in the textile industry have been also exempted from the Professional Tax.

Documents required for Professional Tax Registration

For registration of the above-mentioned tax following documents are required to be submitted-

- The online form filed and the hard copy of the same shall be submitted.

- If the applicant is a Company the COI, AOA & MOA, and PAN of the company (Attested by the Director) shall be submitted and as the applicant is the proprietor, the self-attested PAN Card is required to be submitted.

- List of all the Directors with their employees with their Identity proof and address proof and passport size photo.

- The Company's bank account details with a bank statement and canceled cheque.

- The proof of the Registered Office where the business is run and in the case of rented property-NOC from the owner is required to be submitted.

- Where the applicant is a company-Board Resolution is required to be submitted and In the case of Partnership- the Declaration of consent by the concerned Partner is required to be submitted.

- Salary and attendance register.

Procedure for Professional Tax Registration

The Procedure for the above-mentioned tax registration is different for every state and has different tax slabs. Later upon the requirement of the state, the Professional tax returns need to be filed within the prescribed time period. Professionals/Employer who requires the above-mentioned tax registration shall follow the below steps-

Applying in Offline Mode

The Professional Tax Registration can be applied via offline mode by submitting the application form with the required documents and prescribed fee to the office of the state government.

Applying in Online Mode

Step-1- Filing the Application Online

Firstly, the applicant needs to fill out the online application through the CTD portal of the respective state.

Step-2 -Submit Hard Copy

After filing the application form, the hard copy of the application and the documents attested to it shall be submitted to the concerned department.

Step-3- Examination by the Tax Authority

Later, on the basis of the application, the tax authority shall closely examine the application and point out such data in the application which is not found correct by the authority.

Step-4- Issuance of Registration Certificate

After examining, if the authority is satisfied with the application the approval shall be given for the registration and issue the certificate of registration to the applicant.

But if the examining authority doesn’t find the application correct for registration, in that case, the authority would ask questions regarding it to the applicant which shall be responded to on time.

Forms of Professional Tax

Above discussed tax can be classified into two forms which are given below-

- Professional Tax Certificate of Enrolment

- Professional Tax Certificate of Registration

The Professional Tax Certificate of Enrolment is applied to those individuals who are engaged in the Business, Employment, Trade or Profession. The individuals are liable to pay the Profession Tax to the respective State government [wherein the business is established] by obtaining the Certificate of Enrolment.

The professional Tax Certificate of Registration is for those employers who are liable to deduct the tax from their employee’s salaries. Such employers need to apply for this certificate.

Process of Professional Tax Registration

The following are the step for Professional Tax of Registration

- Business Registration / Incorporation

- Application to Professional Tax Department

- Obtaining a Certificate of Enrollment (EC)

Firstly, one needs to register its business according to its nature as Proprietorship /Partnership / Limited Liability Partnership or a Private Limited Company.

Next, the online application for Employer Registration (Enrollment Certificate) shall be submitted to Professional Tax Department.

After submission of the application, submit the supporting documents to Depart and obtain the Certificate of Enrollment (EC).

Certificate of Enrollment

Every business entity shall obtain the Certificate of Enrollment (EC) from the Profession Tax Officer within Thirty days from the date of commencement of business. The above-mentioned tax registration is compulsory for the business whether there is any employment in the business or not. Every business which has obtained the enrollment certificate shall pay the above-mentioned tax every year at on specified time and rate. Such details shall also be mentioned in every applicant’s certificate of enrollment. Any employer, who fails to register or doesn’t obtain the enrollment certificate within the specified time, shall be penalized for such delay by the assessing authority. The above-mentioned tax for an employer has been fixed to Rs.2500/- for the Company, LLP, and Partnership.

Accountability to Collect and Pay Professional Tax

The Professional Tax needs to be paid by every person who earns income through their profession; trade, etc. It is paid directly by the person who is self-employed. On the other hand, for salaried employees, the liability of tax has been put on the employer for paying such tax on behalf of the employee. It needs to be paid on a pre-determined tax slab either annually or monthly to the Commercial Tax Department of the respective state on the due date prescribed by the relevant authority.

Professional Tax Slab of different States (FY 21-22)

Penalties for violation of Professional Tax Regulation

The Professional Tax has its rules and regulation prescribed by the relevant authorities and such must be complying by the applicant. Violation of such facts would impose penalties on the individuals. The states that are collecting Professional tax, impose a penalty for not registering professional tax once it has become applicable and in the case when the individuals default for professional tax. For such default, the authorities have imposed a fine. Although, the penalized amount differs from state to state. Following are some situations where the authority imposes penalties-

1. Fails To Get Registration

The one who fails to get registered shall be liable to a penalty for the period during which the applicant is unregistered.

2. Fails To Pay the prescribed Tax To The Government/ Late Payment

Any individual who fails to deposit the tax shall be liable to pay for the such time the late fee along with the prescribed amount of taxation.

3. Non-Deposition of Amount

In the case where the individual doesn’t deposit the tax amount, the concerned authorities have the power to recover the amount with penalty and interest from the assets of such individual. In other situations, even prosecution could also be filed on the individual. Further, the authorized state government could also impose a penalty on the individual for delayed payment and for failing to file the return on the due date.

4. Few major Penalties are Imposed on the Defaulter

- If the Professional Tax Registration Certificate is obtained after the due time shall incur a penalty of Rs.5 per day.

- Where the applicant has delayed payment or nonpayment of the Professional Tax, will be liable to pay a penalty of 10% of the amount to be paid.

- If the applicant is liable for late filing of returns, he/she shall pay an amount of Rs. 1000. And if the same is continued for a month, the amount would arose to Rs.2000/-.

Taxsavio Assistance for Professional Tax Registration

Kindly utilize the steps given to integrate legally and securely a Professional Tax Registration and get the benefits in the form of better-quality professional sales and satisfied clients. Our Taxsavioadvisors experts will be at your disposal for assisting you with guidance concerning Professional Tax Registration and its compliance for the smooth functioning of your professional business in India. Taxsavioadvisors professionals will guide you in planning a pocket-friendly budget.

It is advisable that an attorney with “Tax Registration experience” must be appointed to overwhelm many of the potential pitfalls that creep around within Professional Tax Registration and to understand the requirement in detail. The information would be only required from your side along with the prescribed fee to start the process.

Why Taxsavio?

Taxsavio is one of the platforms that work together to meet all of your legal and financial needs while also connecting you with dependable specialists. Yes, our clients are happy with the legal services we provide. They have continually regarded us well and provided regular updates because of our focus on minimizing legal requirements. Our clients can also keep track of the progress on our platform at any moment. Our knowledgeable professionals are here to answer any queries you may have concerning Professional Tax . Taxsavio will make sure that your interactions with professionals are pleasant and smooth. Following are the reasons one should choose Taxsavioadvisors-

- Taxsavio is one of the many platforms which coordinate to fulfill all your legal requirements.

- It connects you with a team of expert professionals who can help you in every possible way.

- Its focus is on simplifying the legal requirements for the client.

- If you have any questions regarding Professional Tax we are just one phone call away.

- We have a very dedicated team that is ready to help you and guide you.

- Our mission is to create a hustle-free and easy-to-use system for the concerned consumers of our services.

- We give you reliability and trust.

- We make sure that we will provide you with the best services and can satisfy you with our quality work.

Professional Tax Registration is an important aspect for every employer and self-paid employee. It is a kind of contribution to the welfare of the state in which one is commencing their business. Also delay in the same in filing or payment process would impose penalties on the individuals. Thus to comply with it on time is the best option. The Taxsavio offer a variety of services along with Professional Tax Registration compliance. Do contact to Taxsavio Professionals for upbringing your business.

Frequently Asked Questions

The Professional Tax relay on fewer restrictions on the applicant and is also a source of revenue for the respective state governments. The excess tax payable could also be claimed for a refund while filing the income tax returns.

It could be understood by its word that it is a type of tax that is imposed on professionals. It is the tax that is deducted from the salary of the Professionals. However, this doesn’t denote the tax shall be payable only when one is in professional practice. Any individual who earns an amount of livelihood through salary is eligible to pay the Professional Tax.

Following are the states where it is not applicable

- Goa

- Delhi

- Rajasthan

- Haryana

- Uttaranchal

- Daman and Diu

- Chhattisgarh

- Andaman and Nicobar Islands

- Dadra and Nagar Haveli

- Jammu and Kashmir

- Arunachal Pradesh

9899615888

9899615888 9899615888

9899615888 9899615888

9899615888