Overview of GST Return Filing

Filling out GST returns is a crucial task that serves as a link between the government and the taxpayer. Every individual or organization registered under the GST Act is required by law to report sales, purchases, and tax paid to the administrative authorities by filing Form GST reports. It is the taxpayer's responsibility to file the GST Return once the GST Registration has been completed. The taxpayer must give all necessary information about the business and transactions, as well as tax declarations and payments, while filing the GST return.GST Return Filing is considered to be filed electronically, which aids the taxpayer in generating an offline GST return and then uploading it to GSTN via the facilitation center.

Furthermore, there are certain aspects of GST returns filing that a person should be aware of before filing the GST Return. Certain GST Returns must be filed on paper and then uploaded to the GSTIN system by the taxpayer or a facilitation center. GST-compliant sales and purchase invoices are expected as a result of the GST return filing service. You can create GST-compliant invoices: An inventory, sometimes known as a bill, is a list of items supplied or services rendered, as well as the amount owed.

Who Qualifies for a GST Return?

GST-registered individuals and companies are required to file monthly and annual GST returns. The GST that must be filed is also determined by the nature of the business. The tax burden must be paid to the government on time once the GST filing is completed.

What are the Most Important Things to Remember When Filing a GST Return?

Depending on the nature of their economic activity, any individual or corporation with a GST Registration under the GST Act, 2017 is required to file GST returns.

In a word, whether an individual or corporation sells things or provides services to others, it must register for GST and make returns on a regular basis. Any registered dealer who engages in the following activities must file a GST return:

- With GST paid on the purchase,

- Sales Purchase Output GST (on Sales)

- ITC (Input Tax Credit).

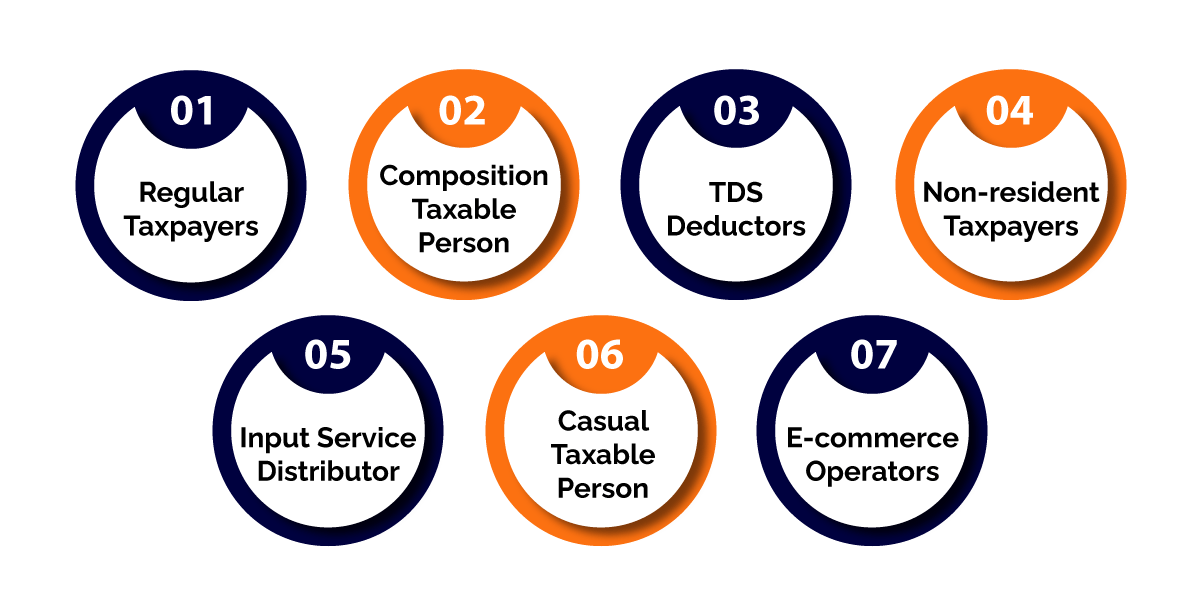

Types of Taxpayers

While understanding the concept of GST returns, it is also necessary to understand the type of taxpayers. There are 7 types of taxpayers. These are as follows-

- Regular Taxpayer

- Composition Taxable Persons

- TDS Detectors

- Non-Resident Taxpayer

- Input Service Distributor

- Casual taxable persons

- E-commerce operators An E-Commerce operator is any person who owns, operates, or manages a digital or electronic facility or platform for E-Commerce activities. Example: Amazon and Flipkart are E-Commerce operators who facilitate third party suppliers to supply goods through their (Amazon/Flip kart) online marketplace.

Taxpayers/businesses with an annual turnover exceeding Rs.1.5 crores [75 lakhs for North Eastern states and Himachal Pradesh] are considered as regular taxpayers and are required to file monthly returns as applicable on the nature of the business.

A taxpayer whose turnover is below Rs.1.5 crore can opt for Composition Scheme. A Composition dealer can also supply services to an extent of ten percent of turnover, or Rs 5 lakhs, whichever is higher.

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (detectors) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

‘Non-resident taxable person’ means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India.

An Input Service Distributor (ISD) is a taxpayer that receives invoices for services used by its branches. It distributes the tax paid known as the Input Tax Credit (ITC), to such branches on a proportional basis by issuing ISD invoices.

“Casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business.

Importance of Filing GST Return

The filing of GST Returns has various importances which are as follows-

1.For Return Filer- Obligatory to adhere the legal compliances

- Assist in calculating the correct tax liability

- A tool to claim ITC

- Source to collect Financial Statistics of Organizations

- Inspect the relevant cases efficiently and effectively

- An origin for future policy making

- Assists in making the future compliance procedures.

- Evasions can be tracked better.

- Efficient mode of obtaining information from the taxpayers.

An Explanation of GST Return Filing Categories in India

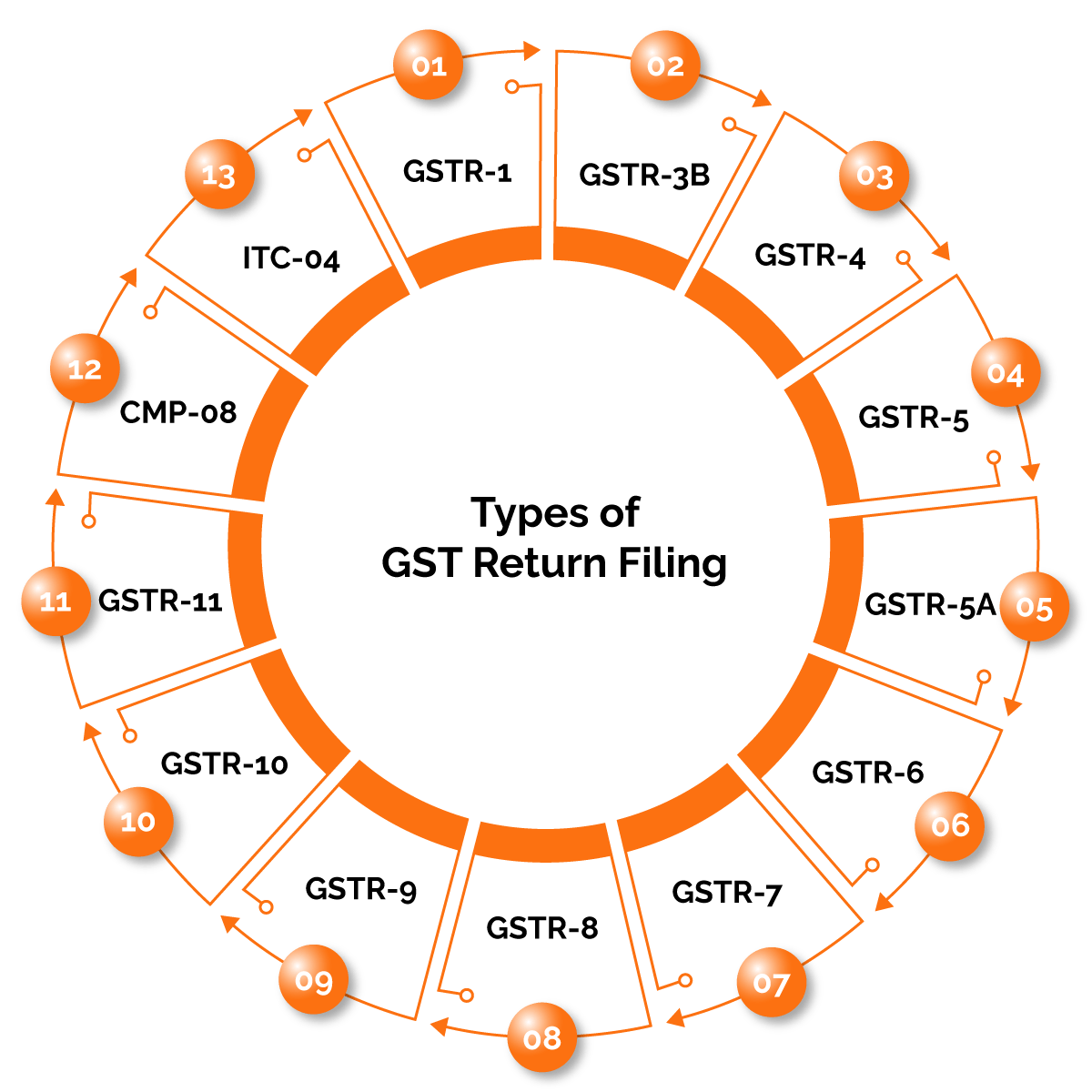

There are 15 types of GST Return available as follows-

GSTR-1 (Return for Outward Supplies)

GSTR-1 has to be filed against all goods and services rendered by a company. This also includes all the invoices raised as well as credit-debt notes against sales for a tax period. Its due date is on 11th of the subsequent every month.

GSTR-2A (Read-Only Return of ITC)

GSTR 2A is a view-only GST return for buying goods and services. It contains the details of all purchases made by the recipient in any month. All kinds of inward supplies to the recipient can be viewed as purchases made from other GST registered suppliers.

GSTR- 2B

This is also a static, view-only GST return. It is important for buyers of goods and services. GSTR-2B is available every month from August 2020 and contains ITC data of any period when it is checked back.

GSTR- 3B

GSTR 3B is a monthly self-declaration. It furnishes the summarised details of-

- All outward supplies made

- Input tax credit claimed

- Tax liability

- Taxes paid

GSTR- 4

GSTR-4 is an annual return to be filed by composition taxable persons. It is to be filed by April 30th following the relevant financial year. This return replaced GSTR-9A.

GSTR- 5

GSTR-5 is for those non-resident foreign taxpayers who carry out transactions in India. What do these returns entail? They contain details of the following-

- Outward supplies made

- Inward supplies received

- Credit-debit notes

- Tax liability

- Taxes paid

GSTR- 5A

GSTR-5A summarises all the outward taxable supplies and tax payable by OIDAR, which stands for the Online Information and Database Access or Retrieval Services provider. This return shall be filed by the 20th of every month.

GSTR- 6

GSTR-6 must be filed by an Input Service Distributor (ISD) every month. Its composition details are-

- Input tax credit distributed and received by ISD

- All the details of all documents related to the input tax credit

The due date of the GSTR-6 is the 13th of every month.

GSTR- 7

GSTR-7 is to be filed by the persons who are required to deduct the TDS under GST. TDS stands for “Tax deducted at source.” Here’s what the GSTR-7 entails-

- Details of TDS deducted

- TDS liability payable and paid

- TDS refund if any

The due date of the GSTR-7 is the 10th of every month.

GSTR- 8

This form is required to be filed by the e-commerce operators registered under GST. They are usually required to collect tax at the source. All the details of supplies made through the e-commerce platform and the TCS on the same are recorded. It is to be filed by the 10th of every month.

GSTR- 9

This is an annual return to be filed by taxpayers who are registered under GST. It is due by December 31st for the year following the specific financial year. The GSTR-9 consists of the following:

- Details of outward supplies made

- Inward supplies received

- Summary of supplies received under HSN code

- Details of tax payable and paid

GSTR- 9C

It is a statement filed by all the taxpayers registered under GST whose turnover exceeds Rs. 2 crores in a financial year. This is a unique form in which it has to be certified by a Chartered Accountant or a Cost Management Accountant after a GST audit and looking over the GST-9. It is to be filed by December 31st of the year that follows the relevant financial year. However, as per the Union Budget 2021, the mandate for the GST audit by CAs and CMAs has been removed.

GSTR- 10

The GSTR-10 form is to be filled by a person whose registration was surrendered or cancelled. It is also called a final return which needs to be filed within three months of the cancellation order or the date of cancellation, whichever comes first.

GSTR- 11

GSTR-11 is for foreign diplomatic missions and embassies that do not pay tax in India but require a refund of taxes. It is filed by those persons who have been issued a Unique Identity Number (UIN) to get a refund for the goods and services incurred by them in India. These returns have details of the inward supplies received and refunds claimed.

GSTN

GSTN or Goods and services Tax Network, is an online portal containing all the details of sellers and buyers registered under GST’s regulation. Businesses and taxpayers can access these details from the GSTN for filing their returns, log invoice data, etc.

Companies have to file a total of 37 returns, one annual return and 3 monthly returns once every 3 months during a financial year. This contains several information, including details of inward and outward supplies instigated by an organisation. The data can be prepared offline and uploaded whenever there is internet connection.

Procedure for Filling GST Return

GST Return can be filed with the software provided by the Goods and Services Tax Network (GSTN), which will auto- populate the forms. The filing process can be completed either with online mode or through offline mode.

Online Filing Process

The GST return online filing process can be completed in the following steps-

- Step 1: Visit government GST Portal.

- Step 2: Based on the state code and PAN number, a 15 digit number will be issued.

- Step 3: Each invoice that have needs to be uploaded. Against each invoice, a reference number will be issued.

- Step 4: After this, the next step is to file the outward returns, inward returns, and cumulative monthly returns. All errors can be rectified.

- Step 5: File the outward supply returns of GSTR-1 using the information section at the GST Common Portal on or before the 10th of the month.

- Step 6: The outward supplies furnished by the supplier will be gotten from the GSTR-2A.

- Step 7: After this, the recipient has to verify the details of the outward supplies and file details of credit or debit notes.

- Step 8: Next, supply details of the inward supplies of goods and services in the GSTR-2 form.

- Step 9: Supplier can accept or reject the details provided by the inward supplies made apparent in the GSTR-1A.

Offline Process

To file the GST returns in the offline mode, one needs to visit and download the following offline tool, Website Link. Once the tool has been downloaded, it can easily be fill in the GSTR-1 and GSTR-2 forms.

Penalty for not Filing Return on Time

If GST returns are not filed within the specified time limits, the taxpayers will be liable to pay interest and a late fee. Interest is charged at 18% per annum. It has to be calculated by the taxpayer on the amount of outstanding tax to be paid. The time period will be from the next day of filing to the date of payment. Late fees are charged at Rs.100 per day per Act. Hence, it will be Rs.100 under CGST and Rs.100 under SGST. The total will be Rs.200 per day, subject to a maximum of Rs.5000/- There has been a change from the month of/quarter ended June 2021, the maximum amount of late fees has been revised as follows-

- Taxpayers whose total amount of central tax payable is NIL, shall be payable a sum of Rs.250/-. And an equal penalty will apply under SGST also. There is no late fee or penalty under IGST.

- Taxpayers with an annual aggregate turnover up to Rs.1.5 crore in the previous financial year, shall pay Rs.1000/-. And same to the SGST.

- Taxpayers with an annual aggregate turnover exceeding Rs.1.5 crore and up to Rs.5 crore in the previous financial year, shall pay a late fee of Rs.2500/- and equal penalty will apply under the SGST also.

Why Taxsavio?

Following are the reasons one should choose Taxsavio-

- Our clients can also keep track of the progress on our platform at any moment.

- Our knowledgeable professionals are here to answer any queries you have.

- We will make sure that your interactions with professionals are pleasant and smooth.

- We always try our best to make our clients happy with the legal services we provide.

- We provide free legal advice.

- Our prices are transparent and reasonable.

- We deliver your work on time.

- We have a team of experts.

- We give a money back guarantees as well.

- 200+ CA and CS assisted us in our work.

- We give an option of easy and convenient EMIs.

The Government has introduced a GST system to smoothen tax processes and bring businesses into the formal economy. Being GST compliant, businesses can experience the merits of having a unified tax system and easy input credits. GST Returns are a transparent method to keep financial transactions accountable. And since it can be done online, it gives the advantage of the ease of access and flexibility. On the other hand, managing the different kinds of GST Return Filing can be complicated affair and understanding the purpose of each return is important to understand the return filing liability of a tax payer is pertinent.

Frequently Asked Questions

Under the GST regime, regular businesses having more than Rs.5 crore as annual aggregate turnover have to file two monthly returns and one annual return. This amounts to 25 Returns each year.

An Offender not paying tax or making short payments must pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10, 000. Ex- Consider in case tax has not been paid or a short payment is made, a minimum penalty of Rs.10, 000 has to be paid. The maximum penalty is 10% of the tax unpaid.

9899615888

9899615888 9899615888

9899615888 9899615888

9899615888