Overview of Partnership Firm Registration

The term “Partnership Firm” denotes a business format that is governed by the provisions of the Indian Partnership Act 1932. Further, this format requires a minimum of 2 people and is based on the concept of Mutual Trust and Principal Agent Relationship.

Usually, a partnership firm as a business structure is chosen by Budding start-ups, small and medium enterprises, entrepreneurs who operates in unorganised sectors.

Moreover, a partnership firm refers to an association of people who decides to mutually carry out a business and share profits earned and losses incurred.

Some of the renowned examples of Partnership Firm are Uber and Spotify, Red Bull and GoPro, Louis Vuitton and BMW, Levi’s and Pinterest, etc.

Concept of Partnership Deed

The term “Partnership Deed” denotes a Magna Carta for the working of a Partnership Firm. All the terms, conditions, duties, rights, rules, and regulations are covered under Partnership Deed. It can be both written and oral. However, it is suggested to a have a written deed to avoid and minimise future havoc and dispute among partners.

Further, it includes all the specifications, details, profit sharing ratios, roles and responsibilities of each partner, nature of work, type of partnership, mode of winding up, etc.

Therefore, a partnership deed is termed as the Bible for a Partnership Firm, as it forms the basis for both firm and partners.

Benefits of a Partnership Firm Registration

The benefits of a Partnership Firm Registration are as follows:

- It requires a minimum of 2 and a maximum of 20 people, However, in case the firm deals in banking activities then the maximum people required will not exceed 10;

- There is no minimum capital requirement;

- A partnership firm is known as the easiest and hassle-free business structures to form;

- Partnership Deed acts as the basis for this business model;

- Provides Ease in Decision Making;

- Offers Ease in Raising Funds through various partners;

Key Features of Partnership Firm

The features of a Partnership Firm Registration are as follows:

- Requires a minimum of 2 people;

- Prescribed Roles and Responsibilities of all the partners working;

- Fewer Compliances;

- Minimal Legal Compliances;

- Easy to Wind-up;

- A Minor is not eligible to become a partner;

- Provides Flexibility and Ease in Decision Making;

- Inexpensive to Incorporate;

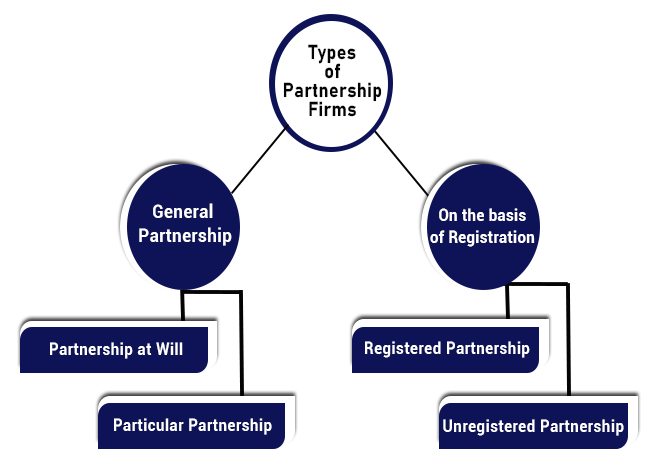

Different Types of Partnership Firms?

The concept of partnership firm is divided into the different types as follows:

General Partnership

Partnership at Will:

The term “Partnership at Will” denotes a firm whose closure depends on the wish of the partners. That means the partners of the firm tend to decide till when they want the said firm to continue.

Particular Partnership:

The term “Particular Partnership” denotes a firm that is created with a motive to carry out a specific project or undertaking. That means this type of partnership firm works on a contract-based project.

On the basis of Registration -

Registered Partnership:

The term Registered Partnership denotes a firm that is registered under the provisions of the Indian Partnership Act 1932.

Unregistered Partnership

The term Unregistered Partnership Firm denotes a firm that is formed just by executing an agreement among the partners. However, it shall be taken into consideration that partners of an unregistered firm are not eligible to sue any third party but can get sued.

Documents Required for obtaining Partnership Firm Registration

In India, the documents required for obtaining Partnership Firm Registration are as follows:

- Application in Form 1;

- Specimen of Affidavit;

- A copy of the Original Certified Partnership Deed;

- Ownership documents of the premise being used as registered office;

- A copy of Lease Deed or Rental Agreement;

- Identity proof for every partner in the form of PAN/ Aadhar Card/ Voter ID/ Driving License/ Passport, etc.;

- Utility Bills in the form of Property Tax Receipt, Water Tax Receipt, Electricity Bill, Property Tax Receipt;

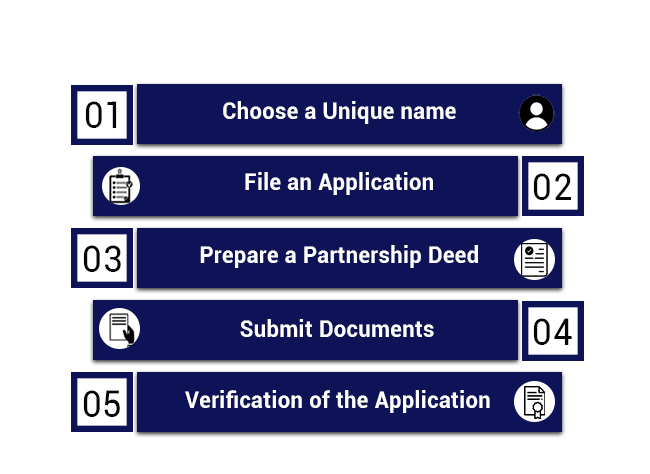

Procedure for Partnership Firm Registration

The steps involved in the procedure of partnership registration are as follows:

Choose a Unique name

The first step in the process of registration is to choose a unique name for firm. However, it shall be taken into consideration that the name chosen must not include words, such as emperor, empire, empress, crown, etc.,

Further, the name selected should not be similar to the name of an existing firm involved in the same type of business.

File an Application

Now, the partners need to file an application in Form 1 to the ROF (Registrar of Firms) for the registration of the partnership firm. Also, the application must be in specified format, together with prescribe fees.

Prepare a Partnership Deed

In the next step, the partners need to mutually draft a partnership deed on a stamp paper. Also, a deed can be both written or oral. However, it is suggested to have a written deed as it reduces the chance of future dispute.

Submit Documents

After that, the partners need to submit all the documents required, together with the deed drafted.

Verification of the Application

After the successful submission of both documents and application, the ROF of the respective state will a Certificate of Registration for the said partnership firm.

Taxsavio Process

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

There are two different types of partnership firm prevalent in India, i.e., Particular Partnership and Partnership at Will and Particular Partnership.

No, it is not compulsory or mandatory to obtain Partnership Firm Registration in India.

9899615888

9899615888 9899615888

9899615888 9899615888

9899615888