Brief of Private Limited Company Registration

Starting any kind of business involves a lot of research and analysis, but as much effort it takes, the outcomes can be very fruitful if you have proper guidance and directions. The very first step of starting any business is choosing the kind of business. There are various kinds of companies available, to start a business. A Private Limited Company is one of the forms of companies that are highly preferred by entrepreneurs these days. We are living in an era where every third person wants to start their own business and for that purpose, it’s easy for them to take Private Limited Company Registration. It is highly preferable because it has less compliance in comparison to other business models and gives better reliability. It is governed by the Companies Act, 2013 and Companies Incorporation Rules, 2014. It is regulated by the Ministry of Corporate Affairs.

What is a Private Limited Company?

It is very clearly defined under section 2(68) of the Companies Act, 2013. A private company means a company having a minimum paid-up share capital and which restricts the right to transfer to its shares the only exception is that in the case of One Person Company, limits the number of its members to two hundred. Provided that where two or more persons hold one or more shares in a company jointly then they shall be treated as a single member. It is a kind of business model which is run by a group of individuals known as shareholders of the company. A private limited company is required to hold an annual general meeting every financial year. It shall appoint a statutory auditor. All the financial statements and board meeting reports are to be submitted by the company. They must file an income tax return every financial year.

Compliances of the Private Limited Company

Following are the compliances of the Private Companies. But the list given below is not exhaustive in nature

- All the members and directors of the private limited company shall be competent as per law.

- Such persons shall be above 18 years of age.

- They must have a sound mind.

- The name of every private limited company must end with “Pvt. Ltd".

- The share division of a shareholder depends on their capital investments in that company.

- All private limited companies are required to get themselves registered under the Companies Act, 2013.

- The hard copy of the online registration must be submitted before the registering authority.

- Private Limited Company Registration is mandatory.

- The minimum number of directors is 2

- The maximum number of directors is 15.

- The maximum number of shareholders is 200.

- One resident Director resides in India for at least 182 days in a financial year.

- A unique and meaningful name should be there.

- It must have a registered office.

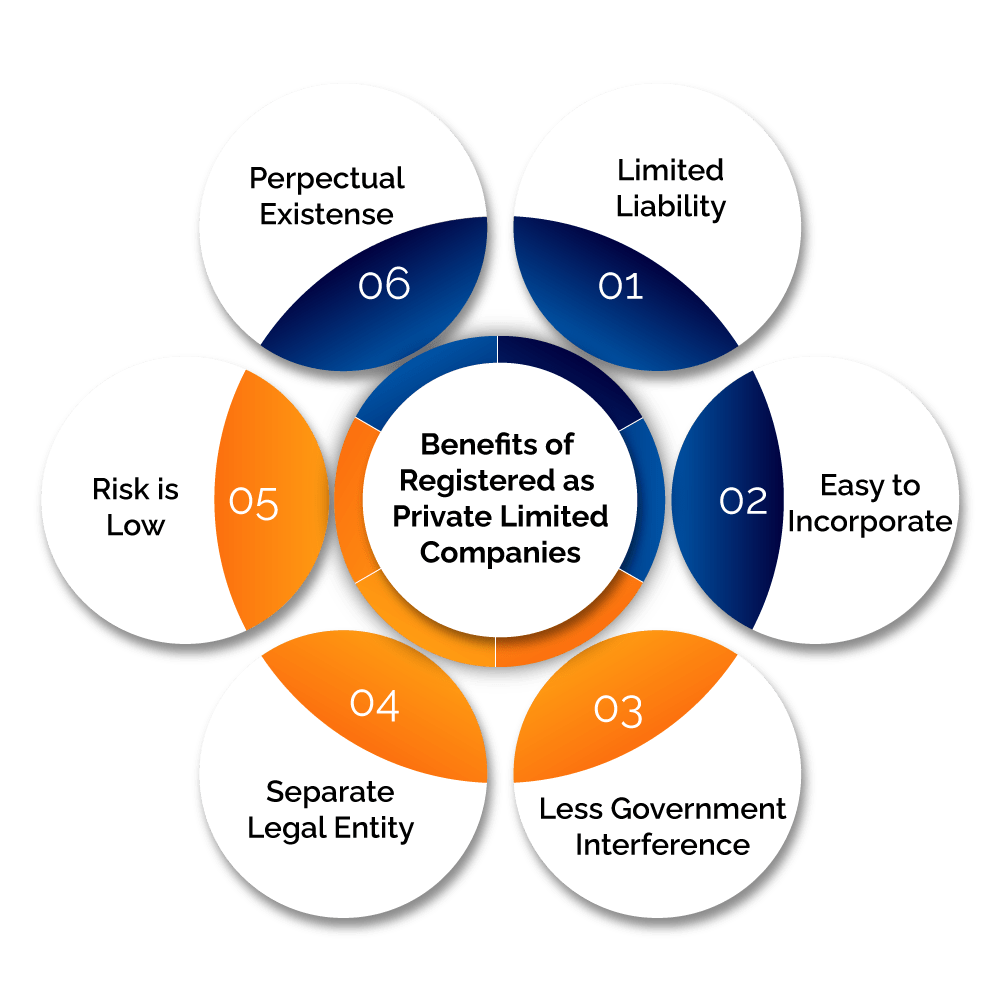

Benefits of registered as Private Limited Companies

Following are the benefits of the above-discussed company, it is very popular and it has its own advantages. Some of its benefits are given below-

- A private limited company has a separate legal status;

- There is an easy entry and exit;

- The company has perpetual succession;

- Foreign direct investment is hugely attracted to private companies;

- A good startup business option;

- The shareholders have limited liability;

- Private companies have significantly less public interference, thus flexibility and autonomy;

- Has the right to sue and be sued;

- Has no minimum paid-up capital requirement;

- A private limited company can easily avail of easy loans from the bank or any financial assistance;

- Purchase and sale of a property can be made in the name of the company;

- Creates a brand name in the market and goodwill;

- Easy funding and borrowing from investors;

- The shares are easily transferred to any member of the company.

Pre-requisites of Private Limited Company Registration

Before applying for Private Company Registration one must fulfill all its pre-requisites so that one can easily get the registration. It must have a minimum number of shareholders and directors. One must have to research properly about the name of the company. Your company’s name must be unique and different. All the documents must be ready because even a single mistake can prove fatal. You must have registered office address proof.

Documents required for the Private Company Registration

General Documents

- Passport size photograph of the directors/ members

- Copy of Aadhar card/driving license/passport

- Residential proof of all the directors of the company

- If any director is an NRI(Non-resident Indian), a copy of the passport is necessary.

- Copy of PAN card

- Copy of educational qualifications of the directors

- Contact number, email id, and the current designation of the directors

- The DIN( Director's identification number ) of all the directors

- Consent from the directors in the form of DIR-2

- The name of the company is to be submitted to the registrar's office.

- Article of Association and Memorandum of Association of the company.

- Subscribers and directors declaration.

- Address proof of the office.

- Recent copy of the utility bills.

- Copy of the incorporation with the foreign body corporate only if it is applicable.

- A recommendation letter in writing from the “Promotional Company” only if it is applicable.

- International Company’s resolution only if it is applicable.

- Nominee’s approval in the prescribed form only.

- Both Address proof and Identity proof of the subscribers and the nominees.

- Identification proof and Address proof of the applicant are also mandatory.

- Unregistered companies’ declaration and resolution.

Documentation which are prerequisites for AGILE-PRO

- Business operation’s principal place address proof is required.

- Appointment proof of the person who is Authorized Signatory regarding the Goods and Services Tax Identification Number.

- Resolution copy from the BOD.

- Letter of Authorization from the Board of directors.

- The resolution copy and acceptance letter which is authenticated by the managing committee itself.

- Authorized Signatory’s identification proof for the purpose of opening a bank account

- Signature of the person who is authorized for EPFO.

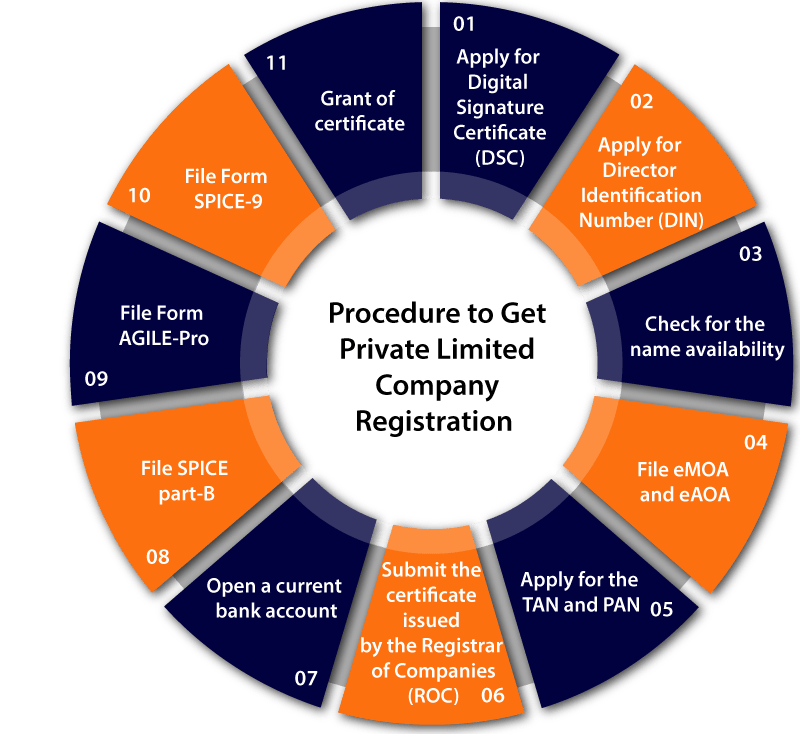

Procedure to get Private Limited Company Registration

Given below is the procedure to get Private Limited Company Registration

- The DSC application form is filled with the required details and, most importantly, a digital signature of the relevant authority.

- The directors are required to fill out Form DIR -3 and submit it to the registrar's office along with the requisite fees and any documents as required. The Director will get a significant DIN number.

- It is done via filling out the RUN (Reserve Unique Name) form along with requisite fees is done before the ROC (Registrar of Companies)

- Apply for the certificate of incorporation.

- As per the latest amendment in the Act, along with all the required information, the digital signature is required to be done by the authority. With the help of form SPICE 32, one can apply for name reservation, incorporation, directors Identification Number, TAN, and PAN number, EPFO, ESIC, and GSTIN.

- Filing of MOU and AOA can be done via form no. Inc 33 and Inc 34, along with the digital signature of the subscribers of the company to be incorporated

- Filing both forms properly is mandatory.

- Upon successfully filling out forms, the MCA (Ministry of Corporate Affairs) will approve the registration and allocate a CIN (Corporate Identity Number). The applicant can track the status using this number.

Who are Taxsavio?

Taxsavio is one of the platforms that work together to meet all of your legal and financial needs while also connecting you with dependable specialists. It is one of the many platforms which coordinate to fulfill all your legal requirements. It connects you with a team of expert professionals who can help you in every possible way. Its focus is on simplifying the legal requirements for the client. If you have any questions regarding Private Company Registration we are just one phone call away. We have a very dedicated team that is ready to help you and guide you. Our mission is to create a hustle-free and easy-to-use system for the concerned consumers of our services. We give you reliability and trust. We make sure that we will provide you with the best services and can satisfy you with our quality work.

Why One Should Choose Taxsavio?

Following are the reasons one should choose Taxsavio-

- We minimize legal requirements.

- Our clients can also keep track of the progress on our platform at any moment.

- Our knowledgeable professionals are here to answer any queries you have.

- We will make sure that your interactions with professionals are pleasant and smooth.

- We always try our best to make our clients happy with the legal services we provide.

- We provide free legal advice.

- Our prices are transparent and reasonable.

- We deliver your work on time.

- We have a team of experts.

- We give a money-back guarantee as well.

- 200+ CA AND CS assisted us in our work.

- We give an option of easy and convenient EMIs.

Conclusion

In the present time when unemployment is at its peak and youths do not have jobs, they are trying their hands in the field of a startup. The government also promotes startups so that our country becomes self-help and employment will be increased. In this situation, a Private Limited Company is the first and best choice of the entrepreneurs because it is easy to maintain and has fewer formalities as compared to other entities under the Companies Act, 2013. One can register Private Companies online. But legal assistance is always required for such works because there is a lot of documentation that you have to do. Even a single mistake can cancel your registration and you have to face a lot of penalties. Such a penalty proves very fatal sometimes. Therefore always hire the best advisor for such work so that your work will be done easily and correctly. Just because the process of getting registration is online does not mean it’s easy, there are a lot of complications that come while applying for the registration and only an expert can help in such times. Hence expert advice is suggested.

Frequently Asked Questions

As per Section 2 ( 68) of the Company Act, 2013 private company means a company having a minimum paid-up share capital as may be prescribed, and which by its articles restricts the right to transfer its shares except in the case of One Person Company, limits the number of its members to two hundred. Provided that where two or more persons hold one or more shares in a company jointly, they shall, for this clause, be treated as a single member. Provided further that persons who are in the employment of the company; and persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment, ceased, shall not be included in the number of members; and prohibits any invitation to the public to subscribe for any securities of the company.

To get the above-mentioned registration follow the steps given below-

- Apply for DSC

- Apply for DIN

- Check name availability

- File eMOA

- File eAOA

- Apply for PAN and TAN

- Submit the certificate issued by the ROC

- Open a current bank account

- File SPICE Part- B

- File Form AGILE-Pro

- File Form SPICE-9

- Grant of certificate

9899615888

9899615888 9899615888

9899615888 9899615888

9899615888